Business Insurance in and around West Des Moines

Researching coverage for your business? Look no further than State Farm agent Steve Curren!

Almost 100 years of helping small businesses

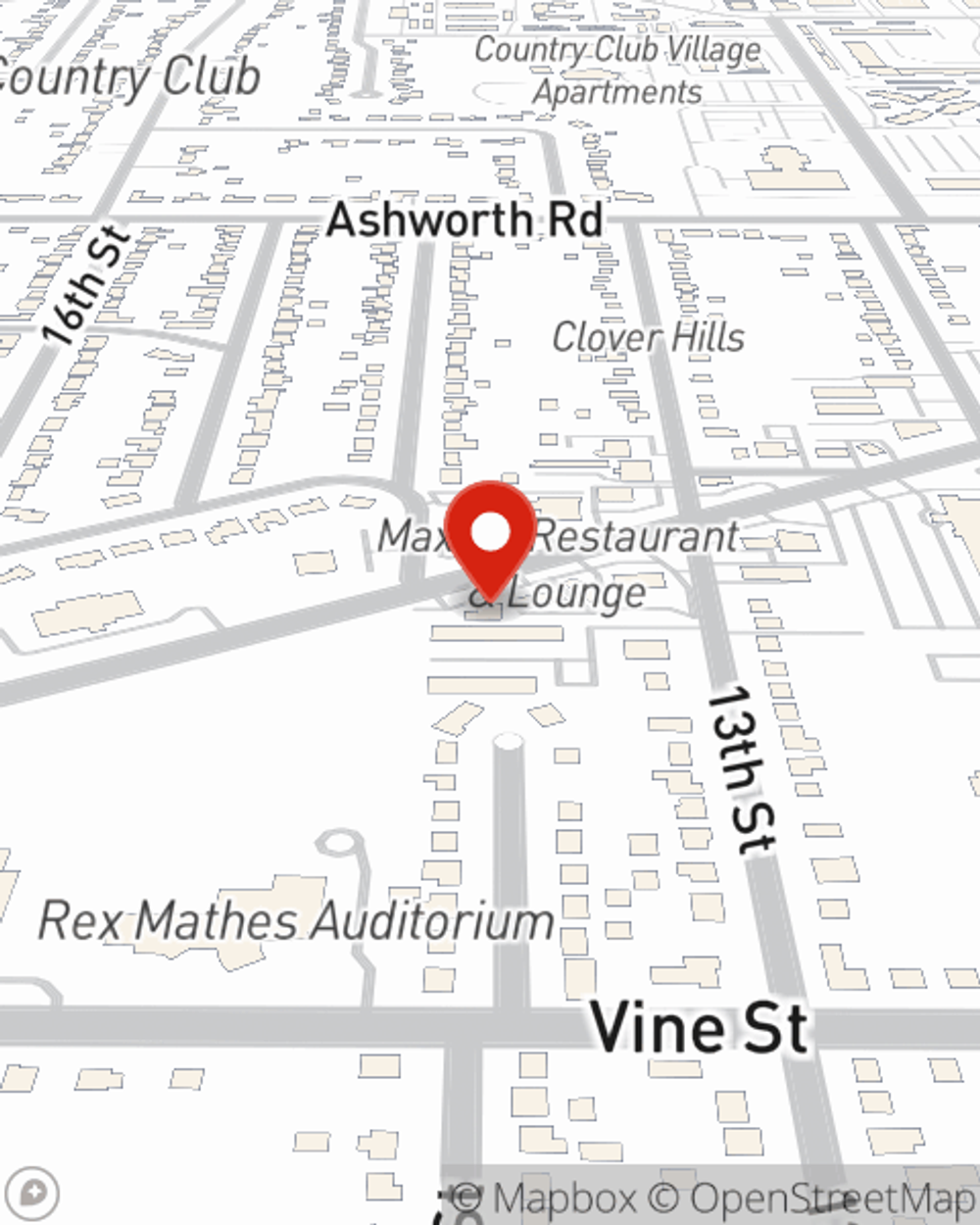

- West Des Moines

- Des Moines

- Clive

- Waukee

- Urbandale

- Ankeny

- Norwalk

- Windsor Heights

- Grimes

- Polk City

- Pleasant Hill

- Altoona

- Valley Junction

- Bondurant

- Polk County

- Dallas County

- Warren County

- Adel

- Van Meter

- Beaverdale

- Minnesota

- Missouri

- Nebraska

- Iowa

Insure The Business You've Built.

Though it's not fun to think about, it is good to recognize that some things are simply out of your control. Catastrophes happen, like a customer stumbles and falls on your property.

Researching coverage for your business? Look no further than State Farm agent Steve Curren!

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

Our business plans rarely account for every worst-case scenario. Since even your brightest plans can't predict consumer demand or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for uncertainty with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your future with coverage like worker's compensation for your employees and a surety or fidelity bond. Terrific coverage like this is why West Des Moines business owners choose State Farm insurance. State Farm agent Steve Curren can help design a policy for the level of coverage you have in mind. If troubles find you, Steve Curren can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and contact State Farm agent Steve Curren to explore your small business insurance options!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".

Steve Curren

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Get paid what you're worth and separate personal and business finances

Get paid what you're worth and separate personal and business finances

When starting your business, you need to separate funds and answer questions like "How much should I get paid?"or "How many hours should I work?".